Major central banks across the world made a number of important decisions in the week ending 23 March 2024. These banks also shared their insights on inflation and potential interest rate changes. These calls were anything but aligned or routine as each major central bank had its own unique dynamics, interpretation of data and expectations contributing to market volatility. Metrics such as reading of inflation, its likely path going forward, condition of the economy, etc. help these banks with monetary policy-making to achieve their goal of bringing inflation to its mandated target. The danger of potential policy error weighs heavily, as economic growth will get curtailed with longer than warranted tighter policy while pre-mature rate cuts will risk doing a U-turn soon if inflation fails to stabilise.

Global Trends

The market was taken aback when the Swiss National Bank, the country’s central bank announced an interest rate cut of 25 basis points (bps) (1 bps = 0.01%). Market participants expected the rates to be left unchanged in this policy and were pricing a cut in 3 months. This led to sharp weakness in Swiss Francs (CHF) in the foreign exchange market.

The US Federal Reserve left the interest rate unchanged, which was in line with the market expectations. However, the market was relieved when the Federal Open Market Committee (FOMC) Chair reiterated that the rate cut would happen soon, and the inflation data of January and February did not dent their confidence that inflation was heading well towards their target of 2%. Recent inflation figures were slightly higher and were bucking the trend of falling inflation over several months. The market had earlier anticipated that the FOMC would express concerns and defer their rate cut further making it “higher for (further) longer.” The recent FOMC members’ “Summary of Economic Projections” (SEP) indicates that they plan to cut policy rate by 75bps in 2024 and 2025, respectively. This means that the Feds Funds target rate range would have decreased from 5.25-5.5% to 3.75-4% by December 2025, implying 6 rate cuts of 25 bps each (median of members projections). This was 7 in September 2023, according to their projection; thus, the need for a deeper cut is seen moderating, suggesting a softer landing for the economy. As indicated by their bets, the market currently expects a 75% chance of that the FOMC will announce the first rate cut during its meeting in June 2024.

The Bank of Japan (BOJ) ended their 8-year-old negative interest regime by increasing overnight policy rate from -0.1% to 0% and removing yield curve control. This was widely anticipated and was not a surprise even though this marks a rate hike after 17 long years. Still the market considered this as a “dovish” step (easing monetary policy) and sold Japanese Yen (JPY), instead of buying JPY on the back of a rate hike. That is a result of BOJ’s declaration that it would continue purchasing bonds despite dropping the yield curve control policy. Earlier, to stimulate the economy, BOJ had adopted the yield curve control policy, in which the market-determined 10-year yield in Japanese Government Bonds (JGB) was capped at 0.5% by the BOJ buying the required amount of bonds. Later, 0.5% was relaxed to imply 1% as a cap, which has further been removed in this policy. However, continued buying of bonds, even without this yield cap, is seen as no major shift in the monetary policy and a large quantum of bets of buying JPY ahead of the policy had to be unwound, thus weakening the currency.

The Bank of England expressed confidence in their inflation management and expects the inflation to move towards the targeted 2% soon. This is the first meeting in which no member voted against a rate hike. Financial markets are pricing in 2-3 cuts of 25 bps each this year. Governor Bailey stated that it ‘is reasonable’ (to expect a rate cut) while quickly clarifying that he does not acknowledge the timing or size of the cut, thus implying that the direction is agreed! As a result, the Pound Sterling weakened for further positioning to play the rate cut cycle.

It is worth mentioning that two other central banks made decisions on their monetary policy to counter the cycle and meet the needs of their respective economies. Turkey and Taiwan both delivered a rate hike in an effort to manage inflation, which is still a challenge.

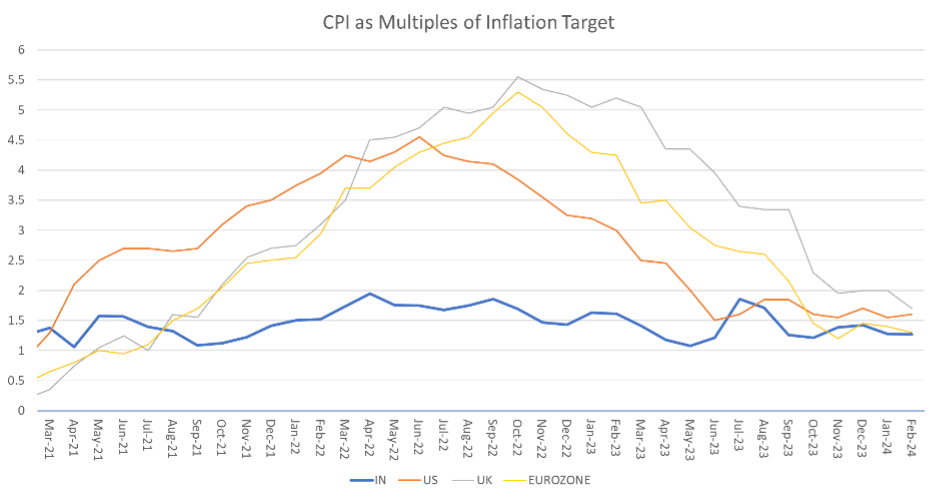

The policy interest rates in major economies are considered to have peaked, as a result of the inflation declining sharply towards target levels in response to unprecedented monetary policy tightening in of those countries. However, the pace of fall in inflation has slowed and the last mile in achieving the target (2% in most major economies) seems to be the most challenging (refer to the following chart). Declaration of victory on inflation is a little pre-mature, especially with many risk factors still remaining to fuel uncertainty on both the demand and supply sides, which could potentially reverse the inflation path and drive it higher. Some of the risk themes the market monitors closely are – Red sea attacks that disrupt supplies and add risk premium on transportation cost, China’s recovery withdrawing the disinflationary effect that it provided to global economy, the Ukraine-Russia war possibly gaining further breadth, a potential oil price rally on OPEC+’s continued efforts, etc.

Source: Author Research

Dynamics in India

Back home in India, inflation in February 2024 at 5.09% (1.3x of target), along with a cautious central bank’s reiteration of their dovish commitment, provided continued comfort on inflation management to the financial markets. Coincidentally, recent inflation data from the US and India were released on the same day, showing a similar movement compared to previous month’s data, but the markets interpreted it slightly differently. The biggest comfort for India is the flat yield curve, instead of an inverted one, a reflection of the ‘in-control’ central bank’s excellent balancing act in managing expectations, with limited yet effective communication for better alignment between policy approach and market price discovery.

Mild differences in their data interpretations and views exist within the Monetary Policy Committee (MPC) rather than the financial markets. One of the MPC members, Prof. Jayanth Varma, has been solely voting for easy policy while the majority has adopted a ‘withdrawal of accommodation’ stance with unchanged policy rates. However, there has been no recent incidence of the market aggressively pricing rate changes by challenging the central bank, which is common in most markets and was formerly the case in India. The Gsec yield curve remains flat, and has not inverted, with yield for 6-months to 40-years being in an extremely narrow range of 7.06-7.17% (as on 22 March 2024).

The central bank governor also assessed that the strong economy, steep credit growth and asset market rally seemingly indicate that tighter policy has not played out fully yet, and transmission is still incomplete. Precautionary administrative steps, recently undertaken by market regulators to prevent an asset bubble, is a healthy sign. It helps retain room for balanced monetary policy-making and for decisions to remain economic data driven, instead of any panic-led reactions in the event of an asset bubble formation.

So, the next dovish step may come at the first sign of a faltering economy. However, it is advisable to cut pre-emptively to avoid a rush to salvage, should the growth slip due to consumption-demand shrinkage. Investment demand surge is largely government-led and a shift to accommodative monetary policy will support more private capex to take over from government capex. However, the inflation falling further towards 4% target is critical for a sustainable rate cut path. The recent swing in banking system liquidity to surplus, and the consequent easing of call money market rates, do indicate potential shift in monetary policy, sooner rather than later. A shift from ‘withdrawal of accommodation’ stance to neutral or accommodative stance followed by a policy rate cut is expected, other factors permitting.

Will RBI MPC shift the stance to accommodative in its April meeting and will the yield curve invert on the back of rate cut expectations? If this happens at a time when global monetary policy reversals are further delayed due to concerns about inflation, will INR be under pressure? Would RBI want to align monetary policy moves and prevent currency impact? These continue to be the key questions in anticipating currency movements going forward. Most likely, the pressure on INR will be decoupled from monetary policy decisions to remain focused on the domestic economy, as the exchange rate management could be done independently and effectively, given the credibility of RBI in doing so.

A Timely Tailwind

Amidst all the likely uncertainty on the currency front, a strong foreign portfolio investors’ inflow into debt market is expected over the next 15-18 months owing to progressive inclusion of India bonds in global bond indices. Considering that this is a known development, market is in the process of discounting this.

JP Morgan and Bloomberg announced inclusion of India bonds in their bond indices, namely, JP Morgan Global bond index Emerging Markets (JPMGBI EM) and Bloomberg Emerging Market Local Currency India (BBG EM LCI), respectively. There are rumours that FTSE, the third large index being tracked, will likely announce an inclusion of India bond index shortly. This is a significant one-time positive factor for India since portfolios tracking these indices will need to buy India bonds to mirror index performance, making it a non-discretionary investment.

Models suggest that $30-40 billion of inflows are expected over the next 15-18 months. On the back of these non-discretionary investments which are sticky in nature, there are also discretionary investments as the participants manage their portfolio weightage of India bonds to express their market views. Since the inclusion announcement in September 2023, about 11 $ billion, an unusually higher than normal amount, has been received under debt portfolio category. The discretionary investments, though, risk an outflow later, should the investors wish to reduce India weightage. Given the absolute and relative strength of the Indian economy, it is unlikely to see large withdrawals any time soon. It is equally possible that there could be an accelerated inflow, to earn higher “interest rate carry”, and also to invest ahead of the rate cut cycle in India. Can this potentially large inflow function as a shock absorber, and will this result in INR strengthening?

Exchange Rate Impact

Currency market witnessed higher inflows as well as view-based hedge-related selling as a result of this. Reported buying by nationalised banks is seen as an intervention by RBI to avoid excessive INR strength on a non-durable factor, such as bond index inclusion led flows. This is corroborated by increased foreign exchange reserves, which rose from $586 billion in September 2023 to $643 billion as of 15 March 2024. With exchange rate stability and market participants’ positioning for INR strength/stability, and without much of an INR weakness risk, it appears that there is a significant buildup of long INR hedge book. This is also reflected in the 1-month USD-INR implied vols (option volatility broadly mirrors INR weakness concerns) progressively slipping to 1.3% in March 2024 from 3.4% in September 2023.

However, RBI was also seen on both sides, selling in the market, supplying USD to ease pressure on bouts of heavy USD buying, to maintain stability. It may be noted that, in the absence of RBI support for INR, and in the background of global dollar strength this week, INR witnessed a sharp 0.5% depreciation, the highest since July 2023, and vols bounced to 2.9% on 22 March 2024. There were reports of large year-end-related buying and suspected unwinding of positions with global USD trend impacting most currencies including Asian peers. Does this indicate a shift in the RBI’s exchange rate management approach?

Preserving global competitiveness by focusing on REER (real effective exchange rate) is seen to weigh in on RBI’s intervention decisions. Aligning the currency movement to other major trading partners and the inflation differential, helps insulating the current account from volatility in capital flows. RBI tracks and publishes REER both on a broader 40 currency basket and a narrower 6 currency basket on a monthly basis. The following table presents data of the last few years, and specifically from the time the debt inflow surged, i.e., October 2023.

Note: Higher REER reading indicates INR strength and vice versa.

As may be noted, despite ensuring stable nominal value of INR through market intervention, the currency has appreciated in real terms. This is likely to provide room for weakness, should there be any pressure on INR due to global factors. It will still remain to be fairly valued, with subdued risk of importing significant inflation.

Letting USD-INR exchange rate fluctuate more and adjust for global currency trends is the likely approach going forward, as against the tight range-bound movement since October 2023. The risk of import surge due to weaker Chinese Yuan (CNY) also needs to be addressed with corresponding INR weakness and stable CNY-INR.

Sterilisation

While the non-discretionary inflow resulting from bond index inclusion is well-priced and positioned, the impact of the actual flows on inclusion is likely to be muted. Still, market participants expect RBI to intervene to absorb any excessive inflow of USD during the inclusion period, thus, the likelihood of any significant INR appreciation is limited. However, if such an intervention occurs, it will most likely bear a significant impact on the monetary policy.

RBI intervention to absorb excessive inflow in foreign exchange market will result in an increase in banking system liquidity. However, the quantum of liquidity will be managed depending on the monetary policy approach at the time. If the infusion of liquidity is excessive and results in more than the assessed liquidity level that is conducive for efficient policy transmission, intervention in spot market will have to be sterilised to suck the excess liquidity out of the system. The sterilisation can either be through open market operations (OMO) where RBI sells securities, or through FX swap market with Sell/buy swaps by building forward purchase book.

Sterilisation through FX swap route is expected to push the forward premia curve upwards, above the level of interest rate differentials, which is not uncommon in India. This will, of course, offer more view-based positioning opportunities, to receive forward premium, expressing a bet on unlikelihood of INR weakness to the extent of elevated forward premium. Similarly, importers will remain unhedged. This can further create hedge skew, resulting in a rush to cover, should there be a trigger for INR weakness later.

On the other hand, OMO will directly support the yield curve when the yield falls due to surge in foreign investors demand (higher demand for securities>>higher prices>>lower yields, as bond price-yield move in opposite directions). The RBI has been focused on ensuring stability in the yield curve since it is a “public good” according the RBI Governor. The term premium in the yield curve, which is the yield for longer period over shorter period, is likely to be maintained to ensure orderly and balanced functioning of the financial markets.

While there are many moving parts which can change the picture and potentially lead to the RBI adopting an appropriate approach, balancing capital flows, monetary policy and exchange rate management will be the central bank’s main challenge. Effectively, a classic “Central Bank’s Trilemma” will probably be on a grand display.